If you’ve been looking for cotton planting, price, and supply numbers, you’ve come to the right place. This is our 4th Quarter Cotton Report (with numbers updated as of 10/6), where we cull stats for the analytical readers who want to know what’s happening with cotton at home and abroad. These will focus on planting and ginning updates, current cotton price comparisons, and supply and consumption numbers. Please note that plantings have no significance in this year-end report, so the planting/ginning update remains the same as last quarter’s report. Any changes from that previous report are indicated with bold type.

Overview: Cotton Prices Reflect Global Supply/Demand

Once again, news coming from China has created a bit of confusion in the global cotton market. In late September, the Chinese government surprised many global cotton experts by announcing that imports of foreign-produced cotton would be limited to the WTA-agreed minimum of 4.1 million bales. China also announced it would support grower prices in the Eastern provinces, even though in the past they have repeatedly stated that they wanted cotton growing moved out of that exact region. Today China holds over 50% of the world’s cotton stocks.

Separately, the weather in India has been conducive for a great crop, with production estimated around 40.4 million bales. This is an 8% increase over 2013. With the restriction on imports noted by China, India will have to find an alternate market for their exports with the 2014 crop. Although the USDA has reported a reduction of close to 1.0 million bales in the U.S. crop for 2014, ending stocks are still forecasted to be 5.2 million bales (equal to 38% of total use).

US Crop Planting/Ginning Update

2013 Plantings in the U.S.: 10.3 million acres (down 16.8% from 2012).

2014 Projected Plantings in the U.S.: 11.3 million acres (up 8.2% from 2013).

The number of acres planted in the U.S. has ranged from 9.15 million acres to 15.27 million acres over the past nine years. Here are regional projections:

- Acreage in the Southeast U.S. is projected to be up 3.6%

- Acreage in the Mid-South U.S. is projected to be up 18.2%

- Acreage in the Southwest U.S., which includes Texas, is projected up by 12.2%

- Western U.S. acreage will be down by 19.5% with California down by 30.1%

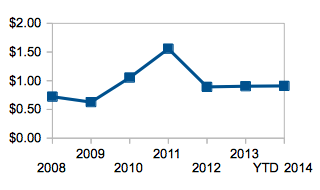

Cotton Pricing Update

A Index (proxy for the world price of cotton)—average of the day’s five cheapest Far Eastern quotations.

| 2008 | $.7221 |

| 2009 | $.6275 |

| 2010 | $1.054 |

| 2011 | $1.557 |

| 2012 | $.8924 |

| 2013 | $.9042 |

| YTD 2014 | $.897 (previously $.9329) |

| Oct 2014 | Off the board (previously $.6845) |

| Dec 2014 | $.6438 (previously $.6765) |

| Mar 2015 | $.6228 (previously $.6823) |

| May 2015 | $.6278 (previously $.6948) |

| July 2015 | $.6332 (previously $.7061) |

Supply/Consumption & Export Update

U.S. Outlook

- U.S. production is unchanged from the last report of 16.5 million bales for the 2014 crop as compared to 13.2 million bales in 2013.

- U.S. Consumption of cotton in 2015 remains at 3.8 million bales as compared to a low of 3.3 million bales in 2011.

- Exports of U.S. grown cotton is changing monthly based on news from China and is currently forecasted to be 10 million bales (down from 10.2 million) by the USDA.

Global Outlook

- Cotton production outside of China has increased to 88.5 (previously 86.6) million bales in 2014 as compared to 84.8 million bales in 2013.

- Global consumption of cotton outside of China is now forecasted to be 75.6 (previously 74.8) million bales in 2014, which compares to 74.0 million bales in 2006.

China Outlook

- China production remains unchanged at 29.5 million bales in 2014, which is down by 9.1% from 2013 and 16% less than in 2012.

- China consumption remains unchanged at 36.5 million bales, or about a 5.8% increase.

- China’s import of cotton peaked in 2011 with 24.5 million bales being imported, 11.0 million bales imported in 2013, and the USDA still projects 8 million bales for 2014/2015.